Tracking the performance of accounts receivable enables organizations to figure out what is working and what is not. Monitoring your accounts receivable (ar) performance metrics can be the key that that unlocks the doors to improved business performance.

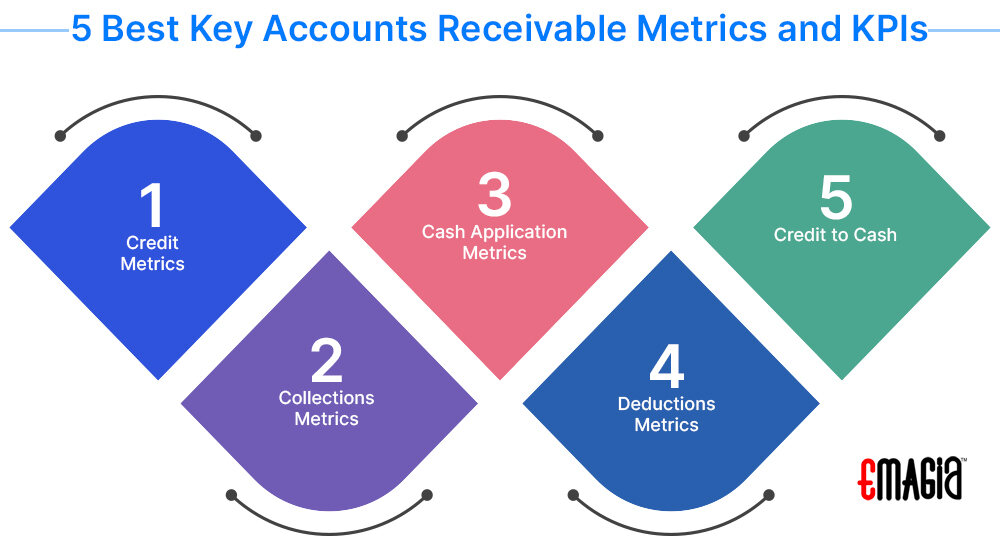

“You can’t manage what you don’t measure” is a widely-accepted rule for managing any operation or process. Makes sense, but the question remains, which and how many individual metrics should be measured to monitor the health of the Accounts Receivable (AR) asset and operations? There are many useful accounts receivable performance metrics and KPIs for gauging the health of the asset. The task of reducing them to just five is not easy, but here they are: Use these for your organization’s accounts receivable performance review.

1. Credit Metrics

Average Days to Complete a New Credit Review

This accounts receivable metric is the elapsed time from receipt of a credit application to the assignment of a credit limit. Given the critical need for additional revenue experienced by most companies in the pandemic economy, this accounts receivable KPI is judged to be more important now than a risk rating of the AR portfolio.

Hackett’s World Class performance benchmark is two days. Achieving this performance level requires an on-line credit application with digital signature and automatic integration with credit bureaus, banks, etc.

2. Collections Metrics

Average Days Delinquent

This AR performance metric measures the gap between actual Days Sales Outstanding (DSO) and the best possible DSO, thereby eliminating the impact of granting extended payment terms.

To achieve Hackett’s World Class performance benchmark of four days, automated, customized collection prioritization logic which drives collector activity and automation of contacts is required.

3. Cash Application Metrics

Auto-Cash Hit Rate

This cash application performance metric measures the percentage of customer payments automatically applied to open invoices without any manual involvement. To achieve Hackett’s World Class performance benchmark of 75%, AI driven, automated extraction of remit data from multiple sources in multiple formats and application to open invoices, enhanced by machine learning, is a must.

4. Deductions Metrics

Average Resolution Cycle Time

This accounts receivable performance metric measures the elapsed time from when a deduction is created in cash application to when it is cleared from the AR ledger or assigned for collection. A short cycle time indicates high productivity and enhances the probability of collecting invalid deductions. Hackett’s World Class performance benchmark is seven days. Achieving this requires AI driven, automated, deduction creation and assignment of reason code, via extracting data from customer vendor portals and remit information from multiple sources in multiple formats.

5. Credit to Cash

Cost of the Credit to Cash Processes as a % of Revenue

This accounts receivable KPI is a cold, simple measure of efficiency. Hackett’s World Class performance benchmark is 0.04%. While best practice processes are important, efficiency of this level requires AI-driven accounts receivable automation that reduces 70 – 80% of manual and semi-manual work in these five functions.

Apart from these key accounts receivable metrics, there are two pitfalls that one needs to avoid when measuring the health of the AR processes and operations:

- Inability to quickly assess the status and emerging problems from failing to measuring the right metricsDevoting too much human resource to compiling and reporting. Every hour spent reporting results reduces the effort available to drive results

The objective of accounts receivable reporting metrics is to measure the effectiveness and efficiency of managing the AR asset, to provide a level (but not a deep dive) of insight into the operations and challenges, and to minimize the time and effort of reporting.

A prerequisite to effective and efficient AR reporting is to have a single, consolidated, global view of it with full detail by customer and by transaction. Without this view, there is a significant risk of missing elements and of expending far too much time and effort on compiling the single view and reporting.

So in order to drive improvements in your order fulfillment, customer experience, cash flow, bad debt risk, and staff productivity we strongly urge you to track these five key metrics.