Emagia’s Credit Risk Management Solutions Software helps businesses take charge of their credit by providing a deeper insight to understand customers’ payment behavior, increasing healthy revenues and minimizing the accounts receivable (AR) risk. The AI-powered solution provides a 360-degree view of customers and their credit risk information in real-time.

Digital World-class Credit Leaders Succeed with Emagia

Accelerate B2B Credit Decisions with AI

- Go paperless with digital credit applications

- Make real-time credit decisions

- Onboard customers 5x faster

- Drive customer engagement 24×7

- Auto-release orders in real-time

- 100% credit risk portfolio monitoring 24x7x365

Transform to Frictionless Digital Credit Ops Just in Weeks

Digital Mobile Responsive Credit Applications

Mobile self-service forms with digital signatures and digital reference checks

Prepackaged RPA Verification Bots

Hyper-efficiency with business validation, license verifications, resale tax certificates

Integrated Global Credit Bureaus Reports

DnB, Experian, CreditSafe, Credit Risk Monitor, NACM, ICTF

Credit Scoring and Auto Decisions Engine

Highly configurable scoring model and risk-based decisions

New and Existing Customer Credit Reviews

New customer credit review, periodic credit review for existing customers, ad hoc reviews on demand for dynamic evaluation

Auto Order Hold / Release in Real-time

Faster order hold and release using algorithmic decision making based on configurable rules.

Delegation-of-Authority

Digital Finance Assistant for Credit

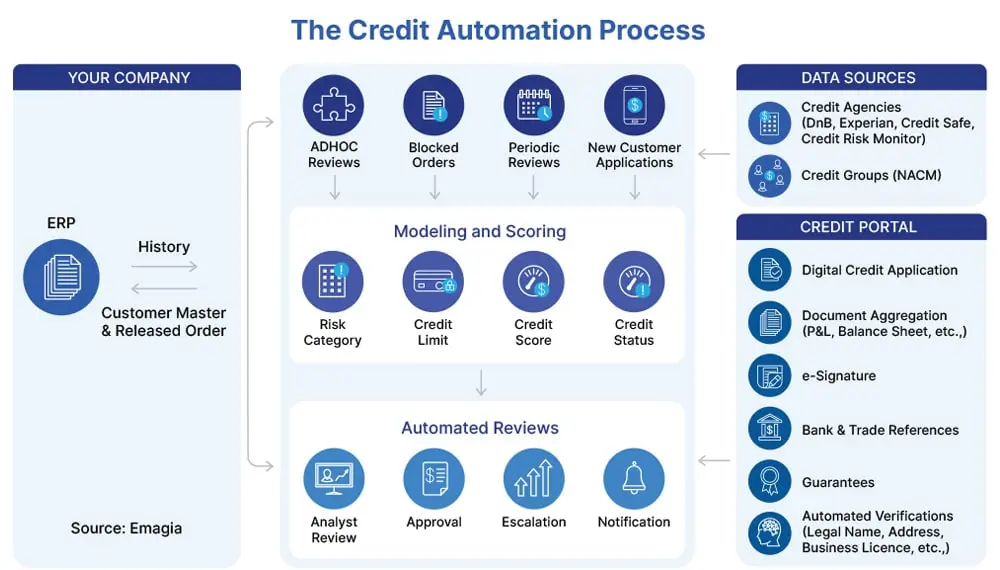

Minimize Your Credit Risk with Real-time Credit Automation

Emagia Credit Management Software Overview

Experience the Emagia Advantage in Your Credit Operations

Emagia’s AI-powered Credit Risk Automation solution delivers actionable insights and empowers businesses with smarter data. Using the latest bureau data and information from peers with customers-in-common, Emagia employs analytics and AI-powered credit predictions to help businesses make credit decisions faster, easier, and in the best interest of your business.

This cloud-based solution integrates seamlessly with leading ERP and other enterprise systems, creating a single workbench for all the company’s credit departments to process any credit related task.

Whether the challenge is reviewing the credit profile of customers, minimizing bad debts, reducing the customer on-boarding time, quicker order processing, continuous analysis of your business risk, or automating credit decisions – you can achieve all this and more with Emagia AI-powered B2B Credit Automation.

Digital Credit Risk Management Made Easy For Global Enterprises

Credit risk management plays a vital role in the health of an organization. As businesses expand, organizations reel under the pressure of making quicker and better credit decisions. The conventional credit review process is complicated and slow, often requiring multiple exchanges with external systems, excel formulas/macros, and interactions with multiple stakeholders for approvals. This process can result in unnecessary and costly delays.

To overcome these process delays and enable businesses to make timely and accurate credit decisions, businesses are increasingly moving towards intelligent credit management tools that quickly ingest data from external sources such as credit agencies and information bureaus to help credit managers build a complete picture of the customer before determining the credit terms and processing credit.

Integrated with Leading

Credit Bureaus

Digital Credit Applications Made Easy

Go paper-less in minutes. Reduce time and costs associated with processing trade credit.

Set up digital credit applications and onboard your customers faster.

Digital World-class Leaders Use Emagia Credit Risk Management

Cali Bamboo Boosts Digital Credit Decisions with Emagia

See how a green building materials company automated the tedious task of manual credit management, and accelerated customer onboarding using the Emagia credit application solution.

Digital Credit Transformation for American Heart Association

See how Emagia empowered one of the world’s largest voluntary organizations accelerate customer credit approvals and onboarding time, while reducing manual efforts in credit processing.

Related Resources

Frequently Asked Questions (FAQs)

A credit management system helps assess the creditworthiness of new and potential customers to grant credit, set the terms on which the credit is granted to ensure a good cash flow and improve revenue. As businesses expand, organizations reel under the pressure of making faster and better credit decisions. A good credit management services helps businesses take charge of their credit with timely, accurate predictions.

Faster credit decisions lead to quicker customer onboarding, increased revenue and minimized credit risk. Business credit risk management involves multiple exchanges with multiple stakeholders such as credit bureaus, and credit risk agencies. If done manually, this takes substantial time and effort. AI-powered business credit risk management can accelerate credit decisions, increase healthy revenues and profitability.

Today as most businesses reel under increased credit risk and bad debt loss, smarter business credit risk management is gaining more prominence. Amidst the rising inflation, increased volatility, and the challenging economic times, business credit risk management has become a topmost priority for most companies.