Credit risk management plays a critical role in the financial health and stability of businesses across industries. It involves identifying, assessing, and mitigating the potential risks associated with extending credit to customers or counterparties. Effective credit risk management enables organizations to make informed decisions, protect their assets, maintain healthy cash flows, and safeguard against default and financial losses.

In today’s dynamic and interconnected business environment, credit risk has become even more significant. Rapid changes in market conditions, economic fluctuations, and evolving customer behaviors necessitate proactive and adaptive credit risk management strategies.

By understanding and managing credit risk effectively, businesses can optimize their lending practices, maintain healthy customer relationships, and secure their financial well-being.

What is Credit Risk Management?

Credit risk pertains to the potential financial loss that arises when a borrower fails to repay a loan. It involves the risk of lenders failing to receive the principal amount and interest owed, leading to disrupted cash flows and additional expenses for debt collection.

Lenders can mitigate credit risk by evaluating various aspects of a borrower’s creditworthiness, including their existing debt obligations and income.

While it is impossible to predict with certainty which borrowers will default, effective assessment and management of credit risk can minimize the impact of such losses.

Lenders and investors accept credit risk in exchange for receiving interest payments from borrowers or issuers of debt obligations. These interest payments serve as a reward for assuming credit risk.

Challenges to Successful Credit Risk Management

Ineffective data management: Difficulties in accessing relevant data in a timely manner leading to significant delays and operational challenges.

Lack of comprehensive risk modeling framework: Without a unified framework, banks struggle to generate sophisticated risk metrics and gain a holistic view of enterprise-wide risk.

Repetitive work processes: Analysts face obstacles in adjusting model parameters efficiently, resulting in unnecessary duplication of efforts and adversely impacting a bank’s efficiency ratio.

Inadequate risk tools: The absence of robust risk management solutions hinders banks from identifying portfolio concentrations or conducting timely portfolio assessments, limiting their ability to effectively manage risk.

Cumbersome reporting procedures: Reliance on manual, spreadsheet-based reporting systems places an excessive burden on analysts and IT departments, impeding efficiency.

Credit Risk Management Steps?

What are the 5 Cs of Credit Risk?

1. Character

For individual borrowers, character refers to their personal traits and credit history. It encompasses factors such as their reliability, integrity, and creditworthiness.

In the case of commercial borrowers, character extends to the reputation and credibility of the company’s management. It also includes the character of the company’s ownership, particularly in the context of private corporations.

2. Capacity

Capacity refers to the borrower’s capability to assume and fulfill their debt obligations. It encompasses the ability of both retail and commercial borrowers to handle their debt.

In the case of commercial borrowers, assessing capacity involves examining various debt service and coverage ratios that provide insights into the borrower’s ability to manage their debt effectively.

3. Capital

Capital is commonly referred to as the borrower’s “wealth” or overall financial stability. Lenders analyze the composition of debt and equity that underpins the borrower’s asset base to assess their capital position.

It is important to determine if the borrower has the potential to obtain additional funds from alternative sources. For business borrowers, this involves examining if there are related companies with available liquidity.

In the case of personal borrowers who may lack an extensive credit history, it is important to consider if a parent or family member could provide a guarantee to support their loan application.

4. Collateral security

In structuring loans to mitigate credit risk, collateral security plays an important role. It is of utmost importance to thoroughly assess the value of assets, their physical location, the ease of transferring ownership and determining appropriate loan-to-value ratios (LTVs), among other factors.

5. Conditions

Conditions encompass the purpose of the credit, external circumstances, and various factors in the surrounding environment that can introduce risks or opportunities for a borrower. These factors may involve political or macroeconomic conditions, as well as the current stage of the economic cycle.

In the case of business borrowers, conditions also encompass industry-specific challenges and social or technological developments that have the potential to impact their competitive advantage.

Examples of Credit Risk Management

ABC Bank is dedicated to assisting individuals in obtaining the necessary finances for their specific needs. To ensure ease of repayment, the bank maintains low-interest rates. As a result, loans are accessible to individuals from all segments of society, provided they meet certain minimum criteria.

In the interest of fairness, the lenders employ an automated system that only accepts loan applications that meet the necessary requirements. This enables effective credit risk management by limiting loan options to individuals with a specified income level.

What is Credit Risk Management Best Practices?

1. Offer Credit Application Forms Virtually

Implement online credit application forms to streamline and expedite the customer onboarding process, Ensure that all essential sections are mandatory to capture all necessary information accurately. By utilizing an online application system, data gathering and storage become more efficient.

Having comprehensive and accurate customer information enhances the effectiveness of credit risk analysis. When designing your credit risk analysis. When designing your credit application, be sure to include the following data fields:

- Company details

- Banking information

- Commercial trade history

- Contingency plans for non-payment scenarios

- Reporting timelines for quality or quantity issues

- Payment terms and conditions

- Dispute resolutions mechanisms

- Rights pertaining to credit term termination data verification processes

2. Analyze Credit Risk

Before extending credit to a customer, it is essential to consider two factors: the customer’s creditworthiness and the potential impact on your cash flow in the even of delinquency. Prior to customer onboarding, conduct a thorough review of their payment history using various financial institutions and sources, including:

Credit bureaus such as D&B and Experian, NACM, Banks, publicly available financial statements, such as income statements, balance sheets, and financial ratios, personal guarantees or trade references.

3. Credit Risk Monitoring

PYMNTS Credit risk management is an ongoing process that requires regular review of existing customers in today’s ever-changing business environment. Real-time credit risk monitoring is crucial to staying informed about potential risks and opportunities.

4. Create a Credit Policy

A credit policy serves as a safeguard for your business against financial risks and the potential default of customers. It provides guidelines and procedures for making credit decisions and establishing payment terms. Regular review and updating of your credit policy are essential to align it with evolving market conditions and industry standards.

5. Clear Terms for Payment Conditions

Effectively communicating payment terms to customers in a clever and timely manner is essential to prevent late payments and foster strong customer relationships. Here are additional tips to enhance customer communications and improve credit risk management:

- Establish precise payment terms: clearly define the terms and conditions of payment, including the frequency of payments, accepted payment methods, and any applicable discounts or incentives for early payments.

- Clarify interest rates and taxes: Provide transparency regarding any interest rates or finance charges that may apply to outstanding balances, as well as any applicable taxes or fees.

- Specify due dates and late payment penalties: Clearly state the deadline by which payments must be made, along with any consequences or penalties for late or missed payments. This helps encourage timely payments and discourages delinquency.

- Include conditions for closing the credit limit: Outline the circumstances under which the credit limit may be revoked or reduced, such as consistent late payments, financial instability, or failure to comply with the terms of the credit agreement.

- Specify clauses for dispute management: Clearly communicate the process for handling disputes related to billing, payments, or other credit-related issues. This allows for efficient resolution of conflicts and helps maintain positive customer relationships.

- By implementing these tips and incorporating them into your customer communications, you can foster a transparent and mutually beneficial credit management process, promoting timely payments and minimizing credit risk.

6. Automation for Faster and Precise Results

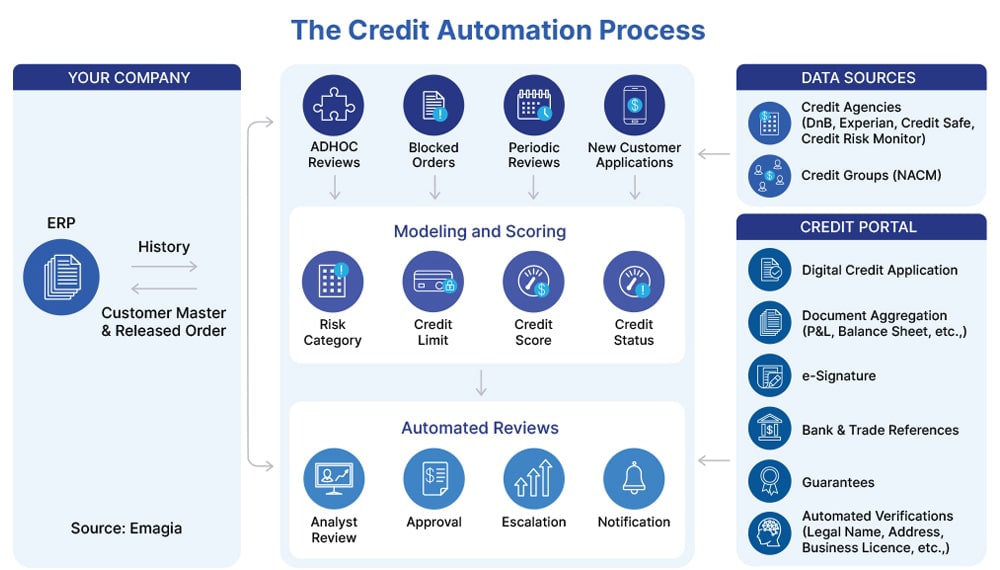

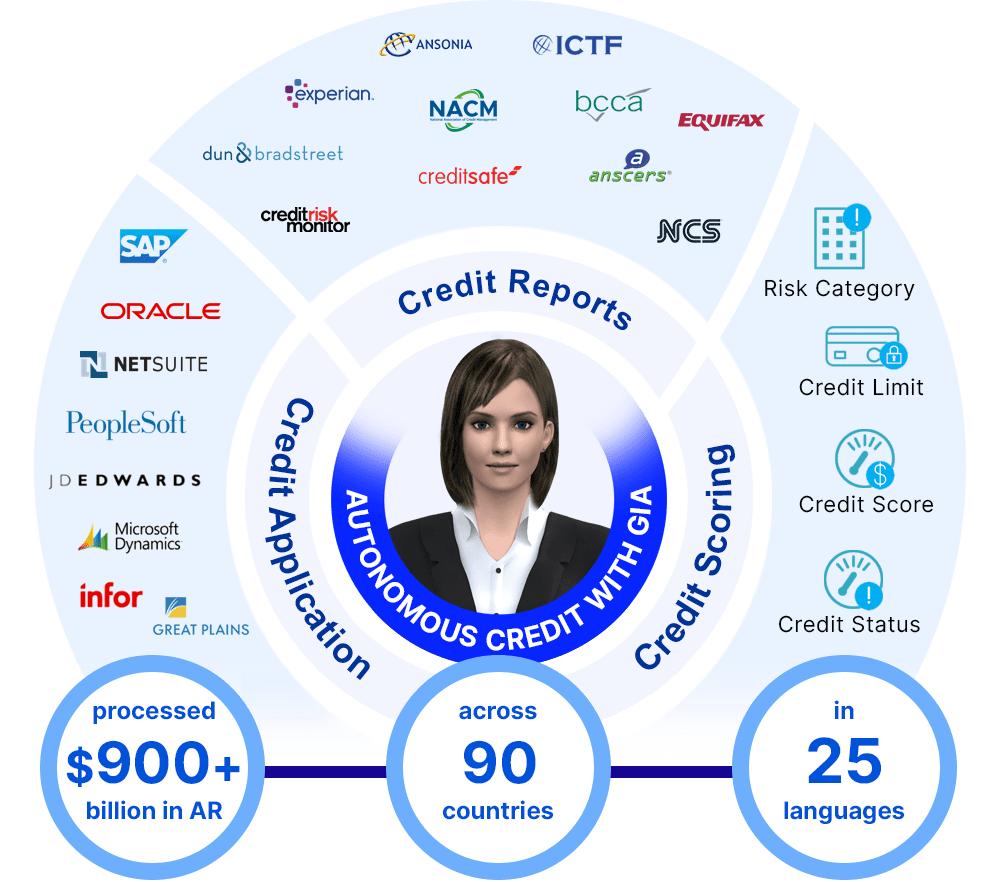

Mid-market organizations are embracing accounts receivable automation solutions at an increasing rate to align with their expanding customer base and mitigate credit risk. The adoption of automation allows for real-time credit management, leading to decreased cedit risk and minimized bad debts. The key benefits of implementing accounts receivable automation include:

Accurate credit decision making: Automation provides the tools and data necessary for making informed and precise credit decisions, enabling organizations to assess the creditworthiness of customers accurately.

Automated periodic review: By automating the periodic review process, organizations can efficiently assess and reassess the creditworthiness of existing customers on a regular basis, ensuring that credit limits and terms remain appropriate.

Faster customer onboarding: Automation streamlines the customer onboarding process, enabling organizations to quickly and seamlessly onboard new customers by automating data collection, verification, and credit evaluation.

Bank and trade reference validation: Accounts receivable automation solutions can automatically validate bank and trade references, ensuring the accuracy and reliability of customer information and reducing the risk of fraudulent or unreliable references.

Real-time credit risk alerts: automation tools provide real-time credit risk alerts, enabling organizations to proactively monitor customer creditworthiness and take prompt action in case of any adverse changes or potential risks.

Alert-triggered credit reviews: Automated systems can trigger credit reviews based on predefined triggers or events, allowing organizations to reevaluate credit limits and terms when necessary to mitigate emerging risks.

By leveraging accounts receivable automation, mid-market organizations can enhance their credit risk management capabilities, streamline processes, and improvise overall financial performance.

Conclusion

In conclusion, credit risk management plays a crucial role in maintaining the financial health and stability of businesses. It involves assessing the creditworthiness of customers, monitoring their payment behaviors, and implementing strategies to mitigate potential risks. Effective credit risk management allows businesses to make informed decisions regarding credit extensions, set appropriate terms and limits, and minimize the likelihood of defaults and bad debts.

FAQs

How is Creditworthiness Assessed?

Creditworthiness is typically assessed by evaluating various factors such as the borrower’s financial stability, repayment history, credit score, income level, and existing debt obligations.

What are the Key Components of an Effective Credit Risk Management Strategy?

An effective credit risk management strategy involves establishing clear credit policies and procedures, conducting thorough credit assessments, monitoring and reviewing customer payment behaviors, implementing risk mitigation measures, and regularly updating credit limits based on changing circumstances.

How can Technology Support Credit Risk Management?

Technology plays a crucial role in modern credit risk management. It enables the automation of credit assessment processes, real-time monitoring of credit risks, data analysis for risk evaluation, and the implementation of early warning systems.

How can Businesses Mitigate Credit Risks?

Businesses can mitigate credit risks by diversifying their customer base and maintaining open lines of communication with customers.

Is Credit Risk Management Only Relevant to Financial Institutions?

No, credit risk management is relevant for businesses across various industries.