The Order-to-Cash (O2C) process is the financial lifeline of every enterprise. Yet, for decades, it has remained bogged down by manual handoffs, siloed systems, delayed payments, and high operational costs. In 2026, that’s changing—thanks to the rise of AI agents transforming the O2C value chain.

The O2C Challenge: Complexity Meets Cost

From credit management and invoicing to collections, deductions, and cash application, the O2C cycle is both mission-critical and inherently complex. For many global enterprises, these processes still rely on spreadsheets, disconnected ERPs, and human labor-intensive workflows.

The result? Sluggish cash flows, high DSO, and missed opportunities for working capital optimization.

The Breakthrough: Finance AI Agents in O2C

AI agents are intelligent digital workers trained to autonomously execute tasks, make decisions, and continuously learn from financial data. In O2C, these agents are reshaping how work gets done—enabling finance teams to shift from transactional tasks to strategic value creation.

At Emagia, our AI-powered O2C suite includes:

- Credit AI Agents for risk scoring, onboarding, and limit management

- Collections AI Agents for dynamic outreach and escalation workflows

- Cash Application AI Agents for 95%+ straight-through processing

- Dispute Resolution Agents for deduction matching and root-cause analysis

- Digital Copilots for real-time insights and exception handling

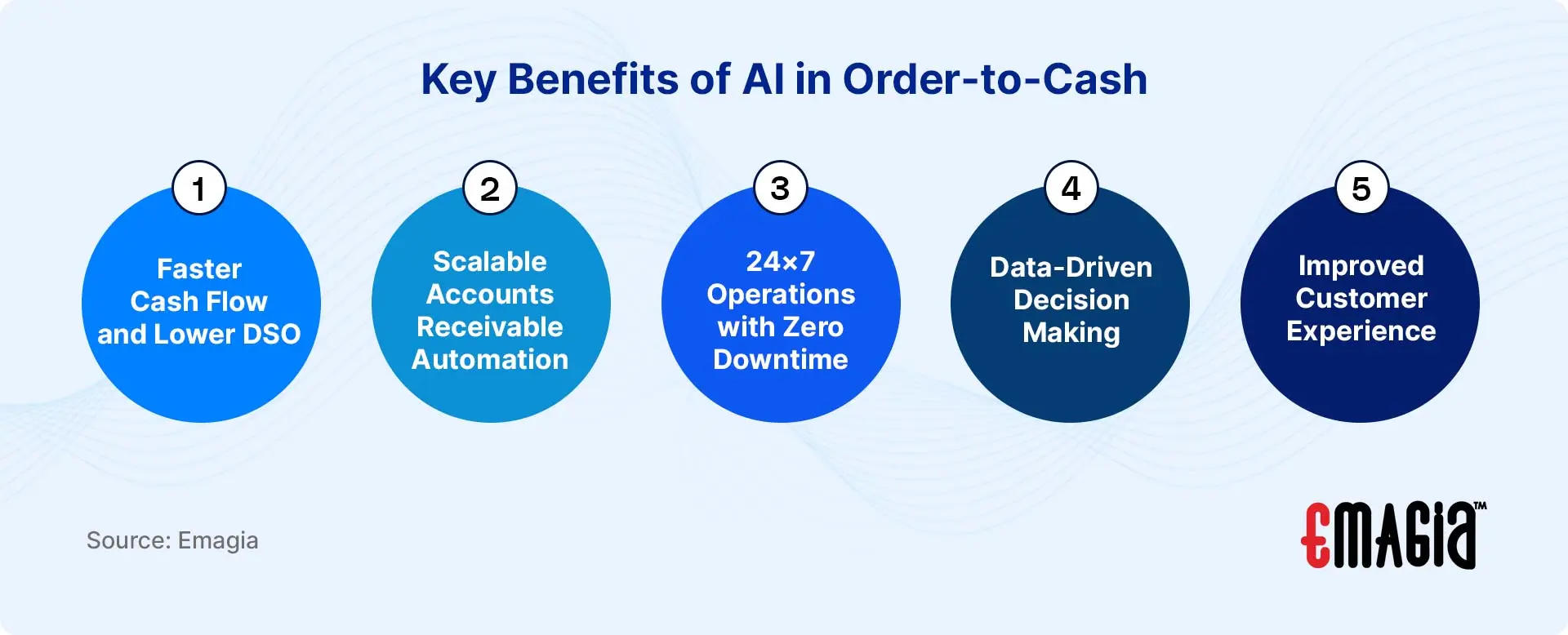

Key Benefits of AI in Order-to-Cash

1. Faster Cash Flow and Lower DSO

AI agents accelerate every step of the O2C cycle, ensuring faster invoice-to-cash conversion and improved liquidity.

2. Scalable Accounts Receivable Automation

From SMBs to Fortune 500s, AI agents scale with business growth—without the need for more FTEs or BPO contracts.

3. 24×7 Operations with Zero Downtime

Digital finance agents never sleep. They operate around the clock, enhancing productivity and responsiveness to customer interactions.

4. Data-Driven Decision Making

AI agents continuously analyze transactions to generate predictive insights—helping finance leaders prioritize actions, mitigate risks, and seize opportunities.

5. Improved Customer Experience

By eliminating delays and reducing disputes, AI agents enable finance teams to strengthen customer relationships through transparency and responsiveness.

Real-World Impact: Autonomous O2C at Scale

At Emagia, we’ve helped global finance teams modernize O2C with measurable outcomes:

- 20%+ reduction in Days Sales Outstanding (DSO)

- 50% increase in collector productivity

- 95%+ automation in cash application

- 40% faster dispute resolution cycles

These are not just automation wins—they are strategic enablers of enterprise performance.

The Future is Autonomous

CFOs leading digital transformation in 2026 recognize that accounts receivable automation isn’t just about efficiency—it’s about agility, visibility, and competitive advantage.

By deploying finance AI agents, they’re future-proofing the O2C process and unlocking new levels of financial performance.

At Emagia, we’re proud to lead this transformation with our Autonomous Finance Platform purpose-built for O2C excellence.

If you’re ready to elevate your O2C operations with AI, the time is now.