In an era defined by volatility, complexity, and digital acceleration, the finance function must evolve beyond traditional roles. As stewards of performance and architects of enterprise strategy, CFOs are uniquely positioned to lead their organizations into the future.

That future is autonomous.

Autonomous finance represents a new paradigm—powered by artificial intelligence (AI), intelligent automation, and real-time analytics—that enables finance operations to run with minimal human intervention. For CFOs, this is more than a technology shift. It is a strategic imperative.

Why the Future of Finance Is Autonomous

The traditional model of finance—centered on labor-intensive processes, siloed systems, and periodic reporting—is no longer sufficient in a world that demands speed, precision, and agility. Leading analysts from Gartner, Deloitte, and McKinsey agree: the next frontier of finance transformation will be defined by AI-driven, autonomous operations.

From order-to-cash to procure-to-pay and record-to-report, autonomous finance delivers:

- Touchless transaction processing

- Real-time decision-making

- Self-learning systems that adapt and improve continuously

- Predictive insights for smarter strategy execution

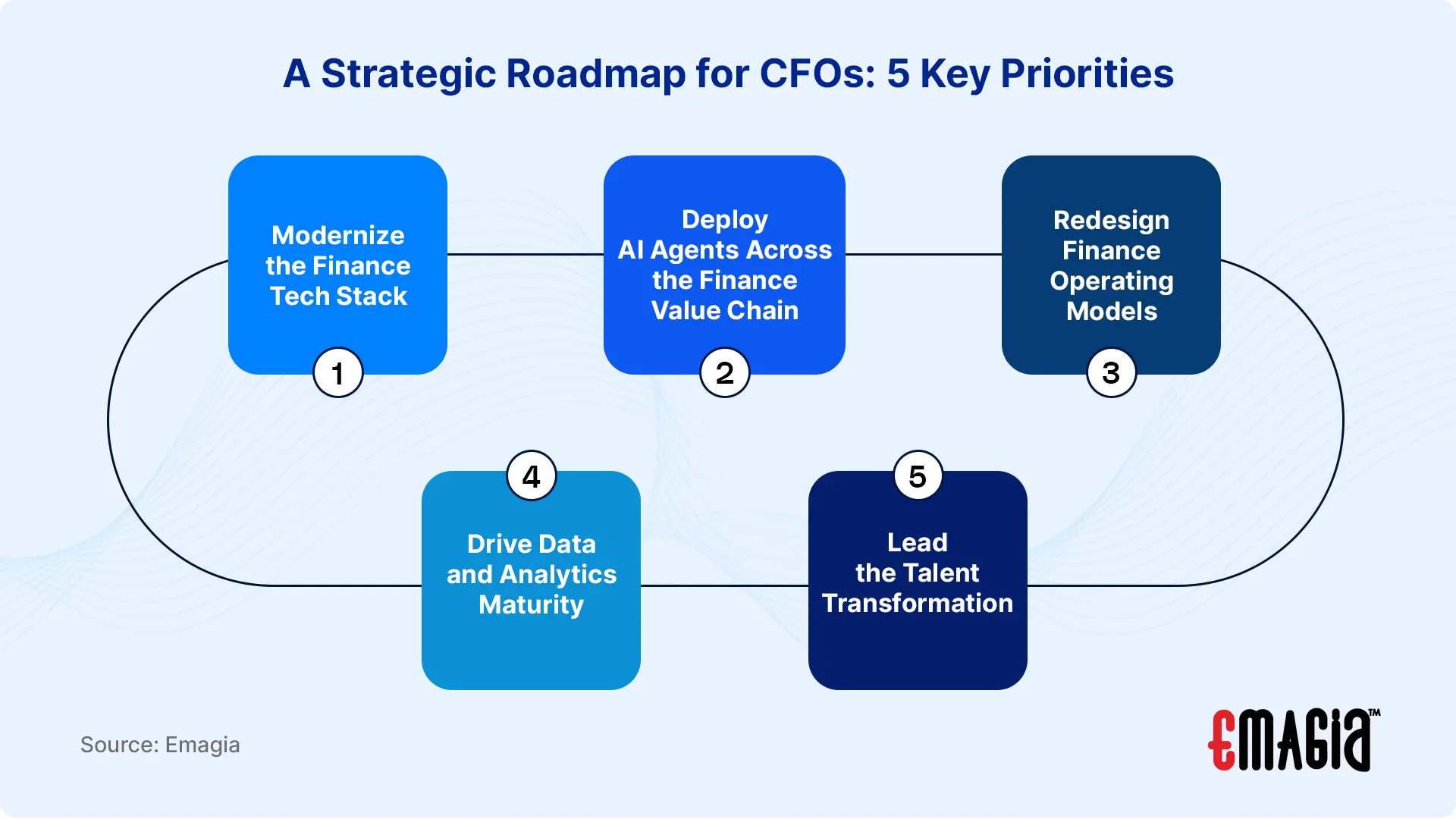

A Strategic Roadmap for CFOs: 5 Key Priorities

To successfully transition toward autonomous finance, CFOs must focus on five key strategic levers:

1. Modernize the Finance Tech Stack

Invest in cloud-native, AI-enabled platforms that can integrate across ERPs, CRMs, and financial systems. Autonomous platforms like Emagia provide a composable, modular architecture for scaling finance automation.

2. Deploy AI Agents Across the Finance Value Chain

Intelligent agents can now handle tasks in:

- Cash application

- Credit risk management

- Collections and deductions

- Invoice processing and reconciliation

This dramatically reduces manual workload and improves accuracy.

3. Redesign Finance Operating Models

Move from function-based silos to process-centric digital finance hubs. This includes redefining roles, workflows, and service delivery using AI copilots and digital finance assistants.

4. Drive Data and Analytics Maturity

Autonomous finance depends on clean, connected, and contextualized data. CFOs must champion data governance and analytics capabilities that fuel predictive intelligence and performance optimization.

5. Lead the Talent Transformation

As automation scales, finance talent must evolve. Equip teams with digital fluency, AI literacy, and data storytelling skills. Create a culture where finance is both a guardian of value and an enabler of innovation.

What Success Looks Like

Enterprises that embrace autonomous finance are already seeing:

- 20–30% reduction in finance operation costs

- 95%+ straight-through processing in cash application

- 40–60% increase in productivity across AR/AP teams

- Faster quarter-end and year-end close cycles

At Emagia, we’ve helped global CFOs achieve these outcomes by deploying AI-driven finance transformation strategies tailored to enterprise scale.

Final Thoughts

The future of finance is no longer a distant vision. It’s here, and it’s autonomous.

CFOs who act now—modernizing infrastructure, rethinking operating models, and embracing AI—will lead not just finance transformation, but enterprise reinvention.

If you’re ready to architect your organization’s autonomous finance journey, Emagia is here to partner with you.