AI-Driven Credit Management Software

for Enterprise Credit Risk Automation

Transform Credit Operations with AI-Powered Intelligence

Emagia’s AI-powered Credit Management Software streamlines credit processes and empowers smarter financial decisions through automation, our platform helps you:

- Minimize risk exposure

- Accelerate credit decision-making

- Streamline customer onboarding

Digital World-class Credit Leaders Succeed with Emagia

Faster, Bolder, Smarter Credit Decisions With AI

How Emagia Transforms Credit Operations

- Reduce bad debt risk by up to 40%

- Accelerate credit approvals by 5x

- Automate up to 80% of credit decisions

- Improve working capital visibility in real time

- Scale global credit operations without adding headcount

Quick Answers About Credit Management Software

What is credit management software?

Credit management software is an enterprise platform that automates the evaluation of customer creditworthiness, approval of credit limits, and monitoring of credit risk across the order-to-cash cycle. It helps companies reduce bad debt, accelerate credit approvals, and improve cash flow visibility.

Who uses credit management software?

Credit management software is primarily used by CFOs, credit managers, accounts receivable teams, and finance leaders responsible for managing customer credit risk and working capital.

What are the main benefits?

- Automated credit approvals

- Reduced bad debt risk

- Faster customer onboarding

- Improved working capital visibility

- Real-time credit risk monitoring

What is Credit Management Software?

Credit management software is an enterprise financial platform that automates the process of evaluating customer creditworthiness, approving credit limits, monitoring financial risk, and enforcing credit policies across the order-to-cash cycle. It helps finance teams reduce bad debt, accelerate customer onboarding, and make faster data-driven credit decisions.

Modern credit management platforms use artificial intelligence, predictive analytics, and global credit bureau data to continuously evaluate customer risk and ensure that businesses extend credit safely while protecting cash flow.

- Automates credit application workflows

- AI-powered customer creditworthiness scoring

- Integrates global credit bureau data

- Monitors credit exposure in real time

- Enforces enterprise credit policies automatically

Key Capabilities of Credit Management Solution

AI-Driven Credit Scoring

Leverage real-time, predictive credit scoring powered by AI to deliver accurate and data-rich risk assessments.

Global Data Integration

Seamlessly connect with leading credit bureaus and real-time financial data sources for comprehensive, up-to-date credit evaluations.

Predictive Risk Insights

Gain early warnings and actionable insights to proactively identify and mitigate potential credit defaults or disputes before they impact your business.

Key Features of Emagia’s Credit Management Platform

Managing credit risk can’t be an afterthought, it needs to be agile, accurate, and proactive. Emagia brings all of that together in one intelligent platform. Here’s how it helps finance teams stay ahead:

Ready to Elevate Your Credit Risk Strategy?

With Emagia, you get more than software-you get a smarter way to manage risk, approvals, and customer relationships.

Business Benefits of Emagia’s Credit Risk Automation

Automating credit risk isn’t just about speed, it’s about empowering finance teams to think strategically, act proactively, and work more collaboratively. Emagia helps organizations make that shift. Here’s how our customers are seeing real impact:

What used to take days can now happen in hours. With automated workflows and real-time scoring, credit decisions are made quickly, keeping sales cycles moving and customer experience seamless.

Eliminate policy fragmentation with a unified approach to credit governance. Emagia enables companies to apply unified credit rules across regions and business units, ensuring every decision aligns with enterprise risk strategy.

When finance teams are equipped with predictive insights and early warning alerts, they can act before risk turns into revenue loss. Many of our clients have seen a measurable drop in write-offs and disputes.

Credit doesn’t operate in a vacuum. Emagia fosters closer alignment between credit, sales, and collections teams through shared data, real-time visibility, and integrated processes.

With live dashboards, AI-backed recommendations, and access to historical trends, decision-makers are no longer flying blind. They’re empowered to take action with confidence and speed.

Manual Credit Management vs Automated Credit Management Software

| Manual Credit Management | AI-Driven Credit Management Software |

|---|---|

| Spreadsheet-based credit analysis | AI-powered credit scoring models |

| Slow manual approvals | Automated credit decision workflows |

| Fragmented data across systems | Unified real-time risk dashboards |

| Limited visibility into customer risk | Predictive risk alerts and analytics |

| Higher probability of bad debt | Proactive risk monitoring |

See How AI Credit Automation Works

Discover how leading enterprises automate credit approvals, reduce bad debt risk, and accelerate revenue with Emagia’s AI-driven credit management platform.

Common Challenges in Online Credit Management

For many organizations, credit management remains a complex and reactive process, especially when reliant on manual workflows or disconnected systems. Here are some of the most common pain points:

Time-Consuming Manual Processes

Reviewing applications and entering data by hand slows down operations and increases the risk of human error.

Fragmented Risk Data

When credit information is spread across ERPs, CRMs, and third-party sources, teams struggle to get a complete and timely view of customer risk.

Inconsistent Policy Application

Without a centralized system, credit policies are often applied differently across regions or departments, leading to compliance issues and inefficiencies.

Lack of Real-Time Insights

Static reports provide limited visibility into current risk exposure, delaying necessary actions and increasing vulnerability.

Delays in Credit Approvals

Bottlenecks in approval workflows not only frustrate sales teams but can also lead to missed revenue and poor customer experiences.

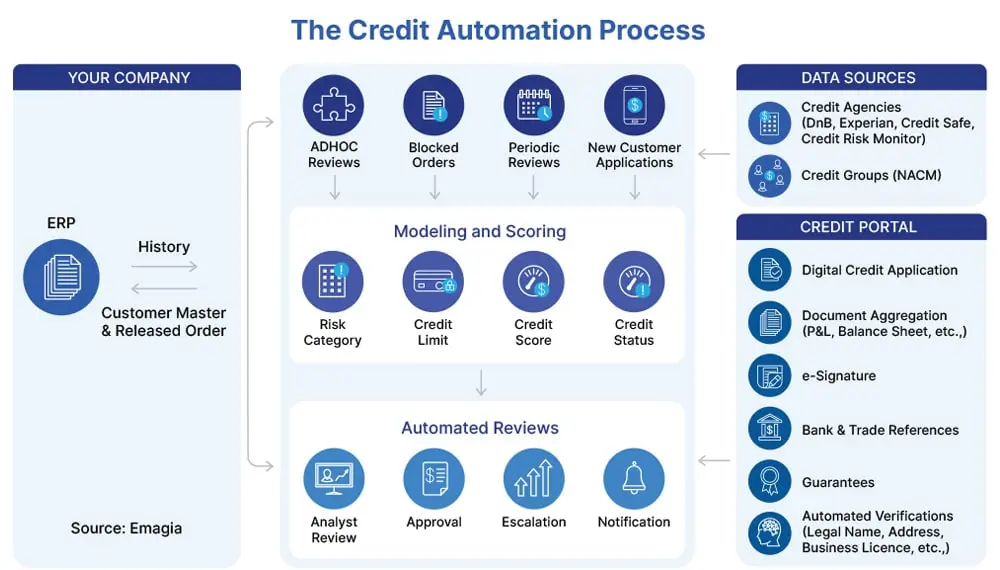

How Credit Management Software Works

Credit management platforms automate the end-to-end credit lifecycle — from customer onboarding to credit monitoring and risk control.

- Customer Credit Application – Customers submit digital credit applications and supporting documents.

- Data Verification – The system gathers financial data, bureau scores, and payment history.

- AI Credit Scoring – Predictive models assess customer creditworthiness.

- Automated Approval Workflows – Credit decisions are automatically approved or routed for review.

- Credit Limit Assignment – The system sets dynamic credit limits.

- Order Release or Hold – Orders are automatically released or held based on risk policies.

- Continuous Risk Monitoring – The platform tracks risk signals and alerts finance teams.

Where Credit Management Fits in the Order-to-Cash Process

Credit management plays a critical role in the order-to-cash (O2C) cycle. It ensures that businesses extend credit responsibly while enabling revenue growth and protecting working capital.

- Customer onboarding with structured credit application processing

- Advanced credit risk evaluation and intelligent scoring models

- Credit limit approval with automated policy enforcement

- Order release management with real-time transaction monitoring

- Accounts receivable tracking with proactive collections management

- Continuous portfolio risk monitoring with predictive insights

Credit Management Software Architecture

Enterprise Credit Management Software Architecture

Enterprise credit management software typically operates through a layered architecture that connects data sources, risk analytics engines, and workflow automation.

- Data Layer – Integrates ERP data, customer payment history, and credit bureau information.

- AI Scoring Engine – Uses predictive analytics and machine learning models to accurately assess and predict customer credit risk.

- Decision Engine – Applies credit policies, business rules, and automated approval workflows to ensure consistent credit decisions.

- Monitoring Layer – Tracks credit exposure and identifies emerging risk signals.

- Integration Layer – Connects with ERP systems such as SAP, Oracle, and NetSuite.

How Emagia Helps Overcome Credit Management Challenges

Managing credit risk doesn’t have to be slow, inconsistent, or manual. Emagia brings together automation, intelligence, and real-time data to help businesses run credit operations more smoothly and effectively. Here's how we make a difference:

Smarter, Automated Workflows

Remove approval delays. With Emagia, applications are automatically routed based on pre-set rules, fast-tracking low-risk cases while flagging those that need closer review.

All Risk Data in One Place

Instead of jumping between systems, Emagia brings together data from your ERP, CRM, credit bureaus, and internal sources, so you always have the full picture in one view.

AI That Learns and Adapts

Our scoring engine isn’t static. It learns from historical data, industry patterns, and customer behaviour to assess risk more accurately over time, helping you make better decisions.

Clear, Consistent Governance

Apply your company’s credit policies across all regions with ease. Emagia makes it simple to enforce global standards while allowing flexibility for local teams when needed.

Real-Time Alerts and Insights

Don’t wait for reports. Emagia keeps you informed with live dashboards and instant alerts, so you can act quickly when something needs attention.

Seamlessly Connect with Your Current ERP Credit Management Systems

Why Credit Risk Automation Is Essential

Credit management has evolved. It’s no longer just a support function—it’s a vital part of a company’s financial strategy. In a world shaped by economic uncertainty, changing customer expectations, and tighter regulations, automation is no longer optional—it’s critical.

Here’s what automation brings to the table:

Stronger Cash Flow Protection

By identifying high-risk accounts early, automation helps reduce defaults and avoid blocked orders, keeping your revenue streams healthy and predictable.

Faster Time-to-Revenue

Automated decision-making accelerates the customer onboarding process—enabling faster approvals and allowing your sales team to close deals without unnecessary delays.

Always Audit-Ready

With built-in documentation, tracking, and decision logic, you’re always prepared for audits and regulatory reviews—no scrambling for paperwork.

Scalable Credit Operations

As your business grows, automation ensures your credit processes can handle more volume without needing to add headcount, while still maintaining accuracy.

A Better Experience for Customers

When approvals are quick and disputes are rare, customers take notice. A seamless onboarding experience fosters trust and long-term relationship.

Key Benefits of Emagia Credit Automation Software

Emagia helps finance teams unlock long-term value by transforming credit operations into a strategic advantage. Here’s how our platform delivers impact where it matters most:

Accelerated Credit Approvals

Speed up decisions and remove bottlenecks, so sales can close deals faster and revenue flows sooner.

Smarter Decisions, Powered by AI

Make confident credit calls with real-time bureau data, predictive analytics, and intelligent scoring models working behind the scenes.

Consistent Global Risk Governance

Standardize policies and workflows across regions and teams, ensuring uniform risk control no matter where you operate.

Lower Operational Costs

Replace time-consuming manual tasks with automation—freeing up your team to focus on higher-value activities.

Better Visibility for Leadership

Gain real-time insights that support strategic planning, portfolio management, and forward-looking risk assessments.

Return on Investment (ROI)

Finance leaders using Emagia typically report a full return on investment within 6 to 9 months. Key ROI metrics include:

60–70% reduction in credit cycle times

— allowing faster deal closure and cash realization

30–40% drop in bad debt losses

— due to proactive risk management and alerts

Up to 80% reduction in manual workload

— freeing up teams for analysis, not data entry

Significant savings on bureau costs

— with consolidated data sources and streamlined subscriptions

4–7 day reduction in DSO

— accelerating working capital performance

How to Choose the Right Credit Management Software

When evaluating credit management software, enterprise finance leaders should consider the following capabilities:

- AI-powered credit scoring and predictive analytics

- Integration with ERP systems like SAP, Oracle, and NetSuite

- Global credit bureau connectivity

- Automated credit approval workflows

- Real-time risk monitoring dashboards

- Scalable architecture for global operations

- Compliance and audit-ready credit policy enforcement

Industries That Use Credit Management Software

Credit management software is widely used in industries that rely on B2B credit transactions and large invoice volumes.

- Manufacturing and industrial supply chains

- Wholesale and distribution businesses

- Technology and SaaS providers

- Healthcare and medical supply organizations

- Energy and utilities companies

- Construction and building materials suppliers

Top Credit Management Software Platforms for Enterprises

Enterprise organizations rely on advanced credit management software platforms to automate customer credit evaluation, streamline credit approvals, and monitor financial risk across the order-to-cash cycle. Modern solutions increasingly combine artificial intelligence, predictive analytics, and workflow automation to improve credit decisions, reduce bad debt risk, and strengthen working capital performance.

While different platforms offer various capabilities, the most advanced enterprise credit management systems typically fall into the following categories:

| Platform Category | Key Capabilities |

|---|---|

| AI-Driven Credit Management Platforms | Automated credit scoring, predictive risk analytics, intelligent credit approvals, and real-time financial risk monitoring. |

| Order-to-Cash Automation Platforms | Integrated credit management, invoicing, collections, and accounts receivable automation across the full O2C lifecycle. |

| Credit Risk Intelligence Platforms | Access to credit bureau data, financial risk signals, and external credit insights for evaluating customer creditworthiness. |

| ERP-Integrated Credit Management Systems | Credit control tools embedded within enterprise ERP systems such as SAP, Oracle, and NetSuite to support financial workflows. |

Categories of Enterprise Credit Management Software

Among modern enterprise platforms, Emagia’s AI-Driven Credit Management Software stands out by combining autonomous finance capabilities, predictive analytics, and intelligent workflow automation in a single unified platform. This enables finance teams to accelerate credit approvals, proactively manage risk exposure, and improve working capital visibility across global operations.

Digital World-Class Leaders Use Emagia’s Credit Management Software Solutions

Cali Bamboo Boosts Digital Credit Decisions with Emagia

See how a green building materials company automated the tedious task of manual credit management, and accelerated customer onboarding using the Emagia credit application solution.

Digital Credit Transformation for American Heart Association

See how Emagia empowered one of the world’s largest voluntary organizations accelerate customer credit approvals and onboarding time, while reducing manual efforts in credit processing.

Emagia’s Credit Management Software Platform Drives World-Class Digital Performance

100%

Paperless credit applications

5×

Faster customer onboarding

24×7

Customer engagement

100%

Real-time order release

24×7×365

Credit risk portfolio monitoring

Core Components of Modern Credit Risk Management Platforms

Modern credit management platforms combine several technologies to automate and optimize the entire credit lifecycle.

- Credit Decisioning Systems – Automate credit approvals using policy rules and predictive scoring.

- Credit Risk Analytics – Evaluate financial risk using historical payment data and external bureau insights.

- Customer Credit Onboarding – Digitize credit applications and documentation.

- Portfolio Risk Monitoring – Track credit exposure across customers, industries, and regions.

- Order Release Automation – Automatically release or hold orders based on risk policies.

Technologies Powering Modern Credit Management Platforms

Modern credit management software platforms combine several advanced technologies to automate financial risk decisions and improve credit governance across global operations.

Machine Learning Models

Predict customer credit risk using behavioral and historical data.

Global Credit Bureau Integrations

Access real-time credit insights from agencies like D&B and Experian.

Workflow Automation Engines

Predict customer credit risk using behavioral and historical data.

Real-Time Risk Monitoring

Continuously track customer financial health and credit exposure.

Enterprise Data Integration

Connect ERP, CRM, and financial systems into a unified credit platform.

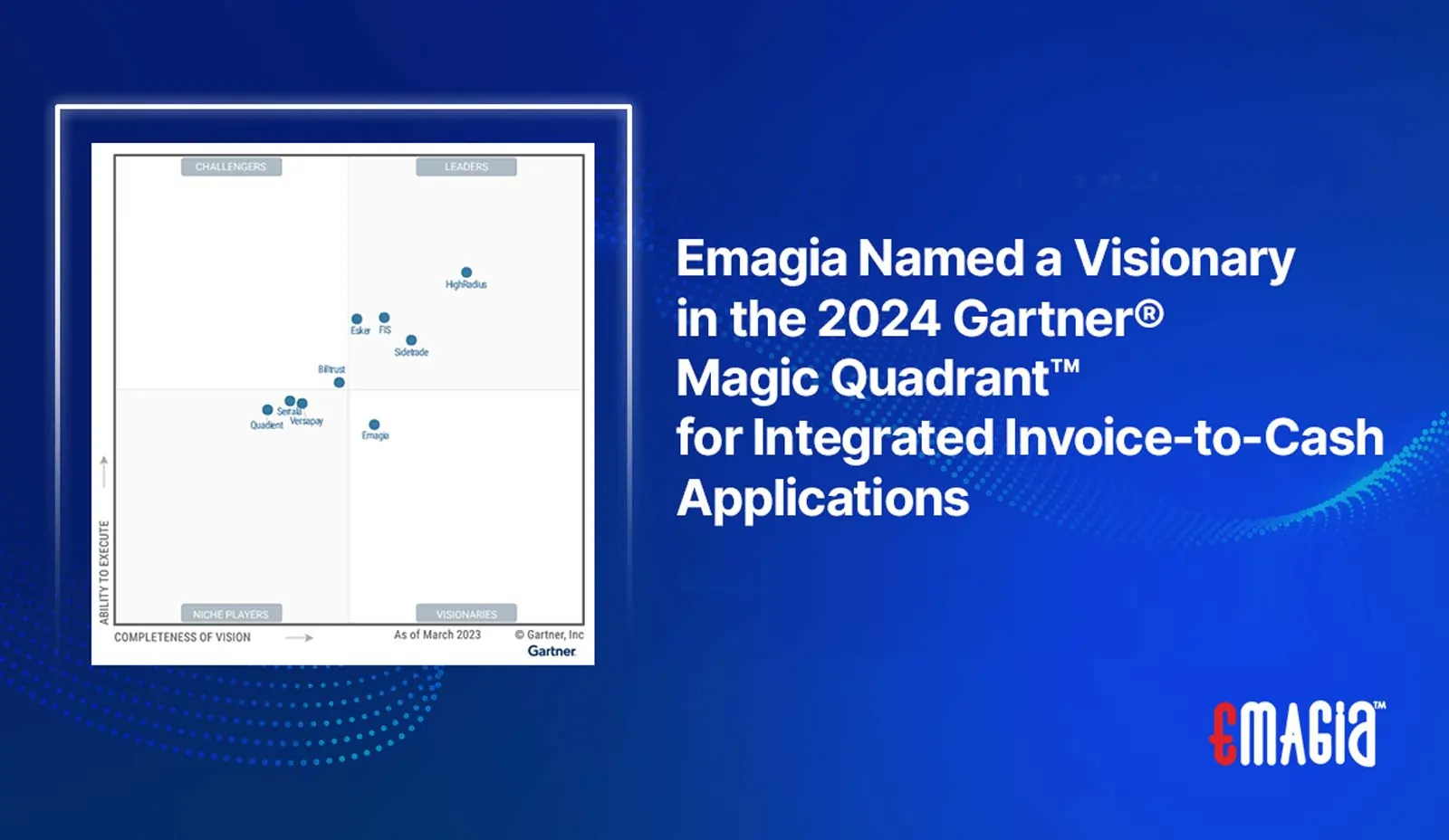

Recognized by Leading Industry Analysts

Frequently Asked Questions (FAQs)

How is Emagia's credit scoring different?

Emagia uses advanced AI to combine internal data, customer behavior, industry signals, and bureau scores into one intelligent, adaptive credit risk score.

Can it integrate with our ERP/CRM systems?

Yes. Our platform connects seamlessly with SAP, Oracle, NetSuite, Salesforce, and more using prebuilt APIs.

Is the credit policy engine customizable?

Absolutely. Credit policies, scoring logic, thresholds, and workflows are fully configurable to fit your organization’s needs.

How does it support global operations?

Emagia supports multilingual, multi-currency, and region-specific rules for enterprises operating globally.

Is the solution secure and compliant?

Yes. Emagia complies with SOC 2, GDPR, and enterprise-grade security standards to ensure data privacy and protection.

How long does implementation take?

Most implementations are completed within 6 to 10 weeks, supported by Emagia’s experienced onboarding and integration teams.