A well-designed Cash Application Workflow plays a critical role in how organizations manage incoming payments, reconcile invoices, and maintain accurate accounts receivable records. As transaction volumes grow and payment formats become more complex, finance teams increasingly rely on structured workflows and automation to ensure timely posting, reduced errors, and consistent cash visibility across the business.

Understanding the Cash Application Workflow in Modern Accounts Receivable

Cash application is the process of matching customer payments to open invoices and posting them accurately in the AR ledger. A structured workflow ensures that payments from multiple channels are captured, interpreted, and applied correctly without delays. This process directly impacts cash visibility, reconciliation accuracy, and overall financial control.

Why Cash Application Is Critical to the AR Lifecycle

Cash application connects payments to revenue recognition and directly influences DSO, aging accuracy, and customer account status. When workflows are inefficient, unmatched payments and unapplied cash increase, creating downstream issues in collections, reporting, and forecasting.

How Cash Application Fits Into the Invoice-to-Cash Process

Within the invoice-to-cash cycle, cash application acts as the final validation step. It confirms that invoices are settled correctly and that payment terms are honored. A streamlined workflow ensures that billing, collections, and reconciliation remain aligned.

Key Stages of a Standard Cash Application Workflow

An effective workflow follows a structured path from payment receipt to final posting. Each stage must be clearly defined to avoid delays, misapplication, or reconciliation gaps.

Payment Receipt and Intake

Payments enter the organization through multiple channels such as bank transfers, lockbox services, checks, and digital platforms. Capturing all payment data accurately at this stage sets the foundation for successful downstream processing.

Remittance Processing and Data Extraction

Remittance processing involves capturing invoice references, amounts, and customer identifiers. OCR for remittance capture and digital extraction tools reduce manual data entry and improve accuracy across high-volume transactions.

Invoice Matching and Validation

Invoice matching connects incoming payments with open invoices based on reference numbers, amounts, and customer data. Advanced workflows handle partial payments, short pays, and overpayments without manual intervention.

Payment Reconciliation and Posting

Once validated, payments are posted to the AR ledger through automated cash posting or ERP cash application processes. Accurate reconciliation ensures financial statements reflect true cash positions.

Cash Application Automation and Its Impact on Finance Teams

Manual cash application slows down posting cycles and increases the risk of errors. Cash application automation replaces repetitive tasks with intelligent workflows that accelerate processing and improve accuracy.

Benefits of Automating the Cash Application Process

Automation enables finance teams to process large volumes of payments efficiently while reducing dependency on spreadsheets and manual reviews. It enhances consistency and improves audit readiness.

Operational Advantages of Automation

- Faster payment posting and reduced unapplied cash

- Improved accuracy in invoice matching

- Lower operational costs and manual effort

- Better visibility into real-time cash positions

AI-Driven Cash Matching and Intelligent Rules

AI-driven cash matching uses historical data and learning models to identify matching patterns. These systems continuously improve accuracy and adapt to complex remittance formats without constant rule updates.

Exception Handling Workflow in Cash Application

Not all payments match perfectly. A strong exception handling workflow ensures unmatched items are routed efficiently for review without disrupting overall processing.

Common Cash Application Exceptions

Exceptions may arise from missing invoice references, partial payments, currency differences, or customer deductions. Structured workflows prevent these issues from creating bottlenecks.

Automated Routing and Resolution

Modern systems automatically route exceptions to the right teams, attach supporting documents, and track resolution timelines to maintain control and accountability.

Integrating Cash Application With ERP and AR Systems

ERP cash application integration ensures seamless data flow between banking systems, AR modules, and general ledger platforms. This integration reduces duplicate work and ensures consistency across financial records.

Benefits of ERP-Integrated Cash Application

Integrated workflows eliminate manual uploads and reconciliation delays, allowing finance teams to close books faster and with greater confidence.

Supporting Lockbox Processing and Bank Feeds

Lockbox processing and direct bank integrations automate payment intake and remittance capture, significantly reducing processing time and improving straight-through posting rates.

Reducing DSO Through Optimized Cash Application

Efficient cash application directly supports faster collections and accurate aging. When payments are posted promptly, collections teams work with reliable data and avoid unnecessary customer follow-ups.

How Faster Posting Improves Collections Performance

Timely application ensures customers receive accurate statements and reduces disputes caused by delayed or incorrect postings. This leads to smoother customer relationships and faster cash realization.

Cash Application Best Practices for DSO Reduction

Best practices include automation adoption, standardized exception handling, continuous monitoring, and collaboration between AR and collections teams.

Security, Controls, and Audit Readiness in Cash Application

Cash application workflows must include strong internal controls to protect financial data and ensure compliance. Automation enhances traceability and reduces manual risk points.

Ensuring Accuracy and Compliance

Automated logs, approvals, and audit trails provide full visibility into every posting action, supporting internal and external audit requirements.

Managing High-Volume Transactions Safely

For enterprises processing thousands of payments daily, scalable workflows ensure consistent performance without compromising security or accuracy.

Industry Use Cases for Advanced Cash Application Workflows

Organizations across manufacturing, SaaS, distribution, and financial services rely on advanced cash application workflows to manage complex payment structures and high transaction volumes.

Enterprise and Shared Services Environments

Centralized workflows support global operations by standardizing processes while allowing flexibility for regional payment methods and compliance needs.

Mid-Market and Growing Businesses

Scalable automation enables growing companies to handle increased payment volumes without expanding headcount or sacrificing control.

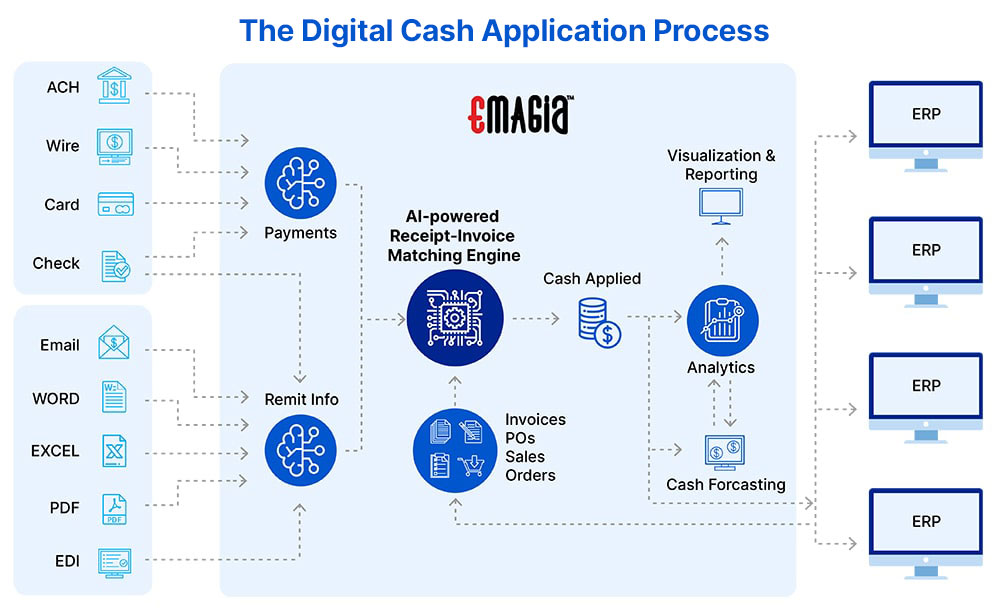

How Emagia Transforms Cash Application With Intelligent Automation

Emagia delivers an AI-powered cash application platform designed to handle complex payment environments with speed and accuracy. The solution automates remittance capture, invoice matching, exception handling, and ERP posting while providing real-time visibility into cash positions. With intelligent learning models and seamless system integration, Emagia enables finance teams to reduce unapplied cash, accelerate posting cycles, and improve overall AR efficiency without increasing operational overhead.

Frequently Asked Questions

What is a cash application workflow

A cash application workflow defines the steps used to receive payments, extract remittance data, match invoices, reconcile differences, and post payments to accounts receivable systems.

How does cash application automation work

Automation captures payment and remittance data, applies matching logic or AI models, routes exceptions, and posts results directly into ERP or AR systems.

Why is invoice matching important in cash application

Accurate invoice matching ensures payments are applied correctly, prevents disputes, and maintains reliable AR aging and reporting.

How does AI improve cash application accuracy

AI analyzes historical patterns, learns customer payment behavior, and improves match rates over time, reducing manual intervention.

What role does OCR play in remittance processing

OCR extracts payment details from remittance documents, emails, and PDFs, enabling faster and more accurate data capture.

How does cash application help reduce DSO

Faster and accurate posting ensures collections teams act on real-time data, reducing delays and unnecessary customer follow-ups.

Can cash application integrate with ERP systems

Yes, modern solutions integrate directly with ERP and accounting platforms to ensure seamless posting and reconciliation.

Cash Application Workflow Related Resources

Webinar

A Step-by-Step Guide to Achieving Digital World Class Efficiency in Cash Application Using AI

Webinar

Reduce Lockbox Fees with Remittance Data Capture AI

Webinar

Reducing Complexity of Cash Application in Europe with AI

Ebook

Lockbox and Remittance Data Extraction with AI

Ebook

Top Financial Use Cases for Intelligent Document Processing

Blog

What is DSO, what does it indicate, and how to calculate it?